|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gap Policy Coverage Guide: Understanding Vehicle Protection for U.S. ConsumersExploring gap policy options can be an essential step for U.S. consumers who want to secure peace of mind and financial protection when it comes to vehicle ownership. In this guide, we'll delve into what gap policy is, the benefits it offers, and how it integrates with extended auto warranties to cover repair costs effectively. What is a Gap Policy?A gap policy, or Guaranteed Asset Protection, is designed to cover the 'gap' between what you owe on your vehicle loan and the car's actual cash value in the event of a total loss. This can be particularly beneficial for new car buyers in bustling cities like Los Angeles or New York, where vehicles can depreciate quickly. Key Benefits of Gap Policy

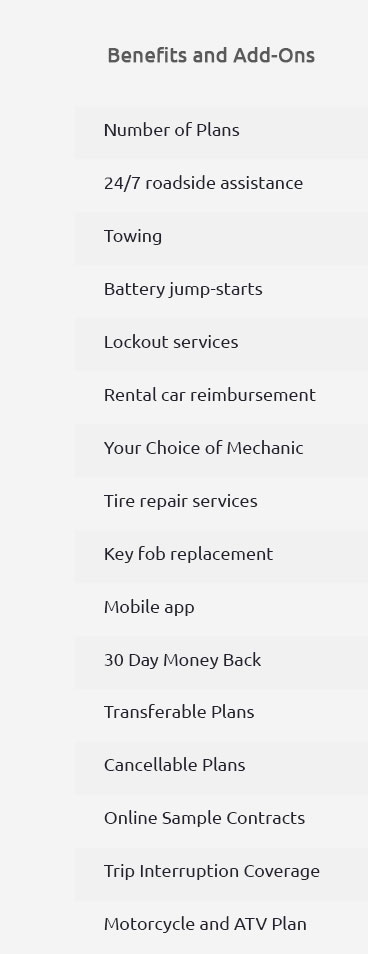

How Gap Policy Works with Extended Auto WarrantiesCombining a gap policy with an vehicle extended warranty calls ensures you are protected from both vehicle depreciation and unexpected repair costs. An extended warranty covers repair costs, while the gap policy handles the loan balance if your car is totaled. Considerations for U.S. Consumers

FAQs on Gap PolicyWhat exactly does a gap policy cover?A gap policy covers the difference between your car's actual cash value and the remaining balance on your loan or lease if the vehicle is totaled or stolen. Is a gap policy necessary for used cars?While not always necessary, a gap policy can be beneficial for used cars that depreciate quickly or if the loan balance exceeds the car's value. Can I purchase a gap policy after buying a car?Yes, many providers allow you to purchase a gap policy after your initial car purchase, although terms and availability may vary by location. Understanding the nuances of a gap policy can help U.S. consumers, especially in regions like San Francisco, make informed decisions about protecting their vehicle investments. Combining it with an extended auto warranty can provide a comprehensive safety net against financial loss. https://en.wikipedia.org/wiki/GAP_insurance

GAP insurance protects the borrower if the car is written off or totalled by paying the remaining difference between the actual cash value of a vehicle. https://www.nationwide.com/lc/resources/auto-insurance/articles/what-is-gap-insurance

Having gap insurance means your insurance provider may pay the financed amount you currently owe on your car at the time of a covered accident, minus your ... https://www.libertymutual.com/vehicle/auto-insurance/coverage/gap-coverage

Gap insurance will cover the difference between the amount you owe on the car and what it's currently worth if it is totaled or stolen.

|